If you remain in the position to buy a home or re-finance your mortgage, now could be a fun time to take advantage of lower rates and potentially score even lower rates by making use of home mortgage points. Bear in mind that you'll wish to build in a little additional time to navigate the lending system as lending institutions are handling an increase of cases due to the historically low-interest rates. how do balloon mortgages work.

The response to whether mortgage points are worth it can just be answered on a case-by-case basis. If you're planning on staying in your home longer than the break-even point, you will see savings. If those savings exceed what you might get in outdoors investment, then mortgage points will certainly be worth it.

This table does not consist of all companies or all available products. Interest does not back or advise any companies. Editorial Policy Disclosure Interest. com sticks to rigid editorial policies that keep our writers and editors independent and sincere. We depend on evidence-based editorial standards, routinely fact-check our material for precision, and keep our editorial personnel totally siloed from our marketers. Origination points, on the other hand, are closing costs paid to a lender in order to protect a loan. While these charges are in some cases negotiable, customers usually have no option about whether to pay them in order to secure a loan. Let's state a prospective house owner makes an application for a $400,000, 30-year home mortgage so they can buy a $500,000 house.

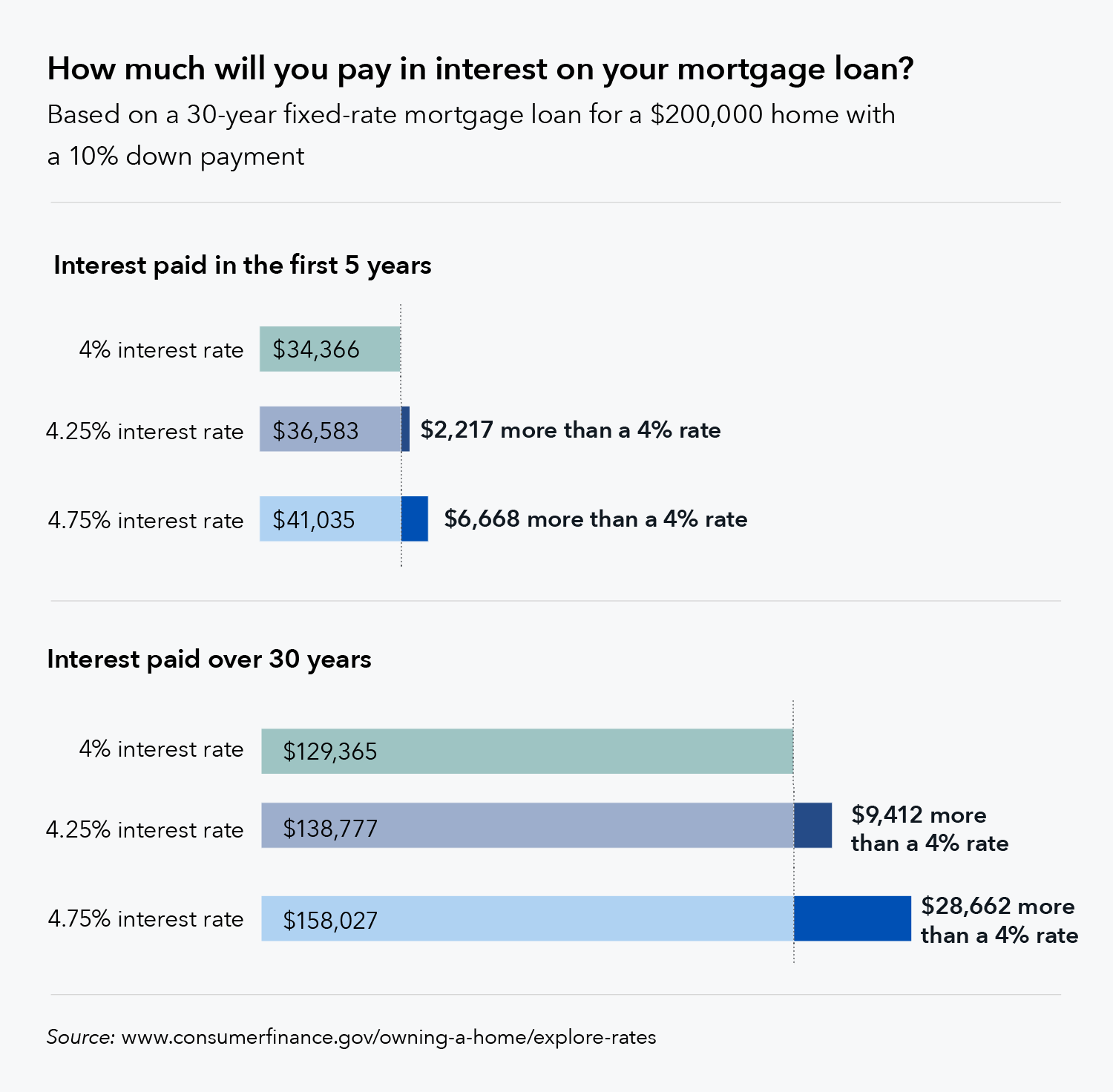

After underwriting, they get a loan offer from a lender that consists of numerous ratesone with their rate if they acquire no points, plus alternative rates if they purchase one to 4 discount points. Below are sample rates for this debtor, upfront expenses to purchase those points and particular regular monthly payments for each rate: In this case, each point would conserve the customer about $60 per month.

5 years) to recoup the expense of each discount rate point they acquire. When you make an application for a loan, both discount rate points and origination points are in theory flexible - how do bad credit mortgages work. But, in practice, that's not constantly the case. The only method to know for sure is to talk to your loan officer when you've been authorized for a loan.

Then, when you get loan offers, you can let each lending institution work to earn your business by negotiating lower rates or closing expenses. You don't require to stress over this harming your credit report, as credit bureaus deal with credit checks from multiple home loan lenders within about a 30-day duration as one credit check.

When you buy discount rate points (or "purchase down your rate") on a brand-new mortgage, the cost of these points represent pre-paid interest, so they can generally be subtracted from your taxes just like normal mortgage interest. Nevertheless, you can typically just deduct points paid on the very first $750,000 borrowed. In other words, if you get a $1 million mortgage and purchase one point for $100,000, you can just deduct $75,000 (1% times $750,000).

Top Guidelines Of How Do Reverse Mortgages Work?

According to the IRS, the expenses for home mortgage https://www.inhersight.com/companies/best/reviews/management-opportunities points can be detailed on Set up A of your Form 1040. The Internal Revenue Service says that "if you can subtract all of the interest on your home loan, you might be able to deduct all of the points paid on the home loan." Mortgage pointsboth discount points and origination pointsincrease a debtor's upfront expense of getting a home loan.

When it comes to discount points, these expenses are likewise optional. If you prepare to stay in your home for at least 10 to 15 years and wish to minimize the month-to-month cost of your home mortgage, they might be worthwhile, but they aren't required.

These terms can often be used to imply other things. "Points" is a term that home mortgage lenders have utilized for numerous years. Some lending institutions may utilize the word "points" to refer to any upfront cost that is calculated as a portion of your loan quantity, whether or not you receive a lower rate of interest.

The details below describes points and loan provider credits that are connected to your interest rate. If you're thinking about paying points or getting lending institution credits, constantly ask lenders to clarify what the influence on your rates of interest will be. Points let you make a tradeoff between your upfront costs and your regular monthly payment.

Points can be a great option for somebody who understands they will keep the loan for a very long time. Points are calculated in relation to the loan amount. Each point equates to one percent of the loan quantity. For instance, one point on a $100,000 loan would be one percent of the loan amount, or $1,000.

Points do not have to be round numbers you can pay 1. 375 points ($ 1,375), 0. 5 points ($ 500) or even 0. 125 points ($ 125). The points are paid at closing and increase your closing expenses. Paying points decreases your rates of interest relative to the rates of interest you could get with a zero-point loan at the exact same lending institution.

For example, the loans are both fixed-rate or both adjustable-rate, and they both have the same loan term, loan type, very same deposit amount, and so on. The very same type of loan with the same lending institution with 2 points ought to have an even lower interest rate than a loan with one point.

Some Known Factual Statements About How Will Mortgages Work In The Future

By law, points listed on your Loan Price quote and on your Closing Disclosure should be connected to an affordable rate of interest. The specific amount that your rate of interest is decreased depends upon the specific here lending institution, the kind of loan, and the general home mortgage market. Sometimes you may receive a reasonably big reduction in your rate of interest for each point paid.

It depends upon the specific lending institution, the sort of loan, and market conditions. It's likewise crucial to comprehend that a loan with one point at one loan provider may or might not have a lower interest rate than the same kind of loan with no points at a different loan provider. Each lending institution has their own rates structure, and some lenders may be more or less pricey general than other loan providers regardless of whether you're paying points or not.

Check out current interest rates or discover more about how to buy a home loan. Lending institution credits work the same method as points, however in reverse. You pay a greater rate of interest and the loan provider offers you cash to offset your closing expenses. When you get lending institution credits, you pay less upfront, but you pay more with time with the greater rate of interest.

For instance, a loan provider credit of $1,000 on a $100,000 loan may be referred to as unfavorable one point (since $1,000 is one percent of $100,000). That $1,000 will look like a negative number as part of the Lender Credits line product on page 2, Area J of your Loan Price quote or Closing Disclosure (how do adjustable rate mortgages work).